Turn Gen Z Into Members For Life

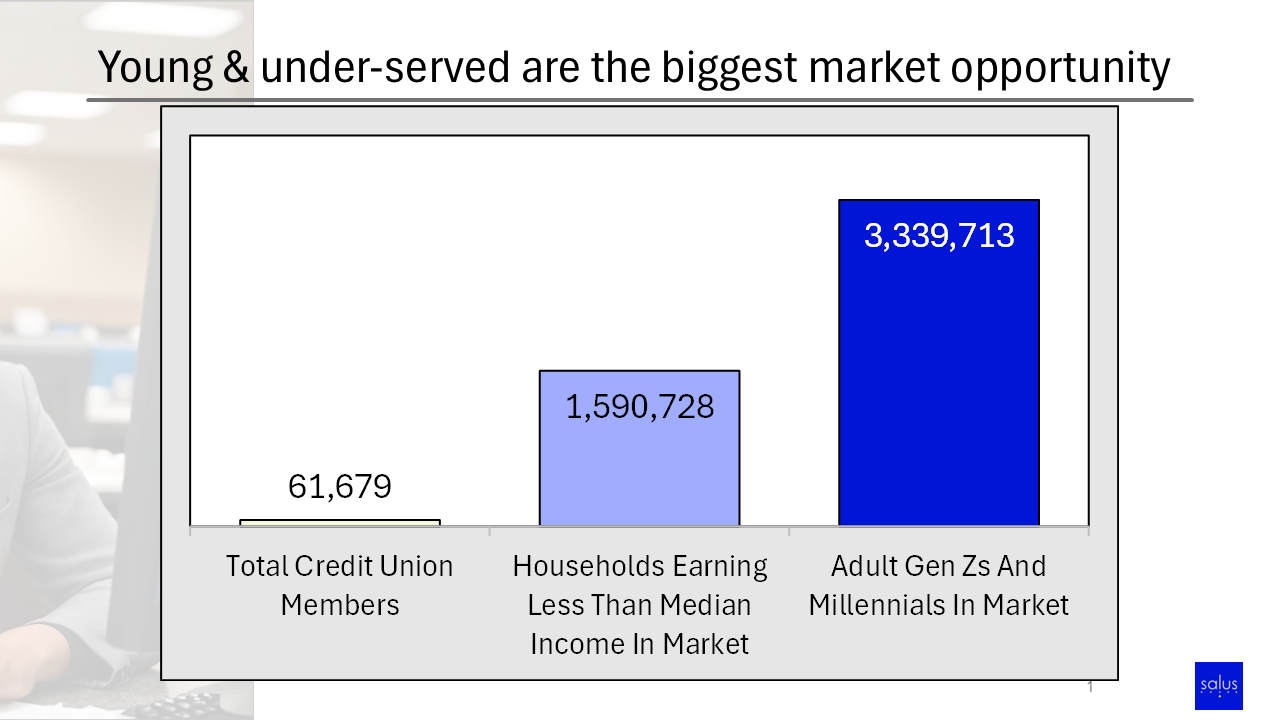

Meet younger, under-served members with the products they need, and become their go-to financial services provider.

- CUSTOM market Analysis -

Find the Opportunity in Your Community

Credit unions want to serve the young and under-served. But sometimes making the business case with numbers is difficult. That's why Salus offers a FREE custom market analysis for any credit union upon request.

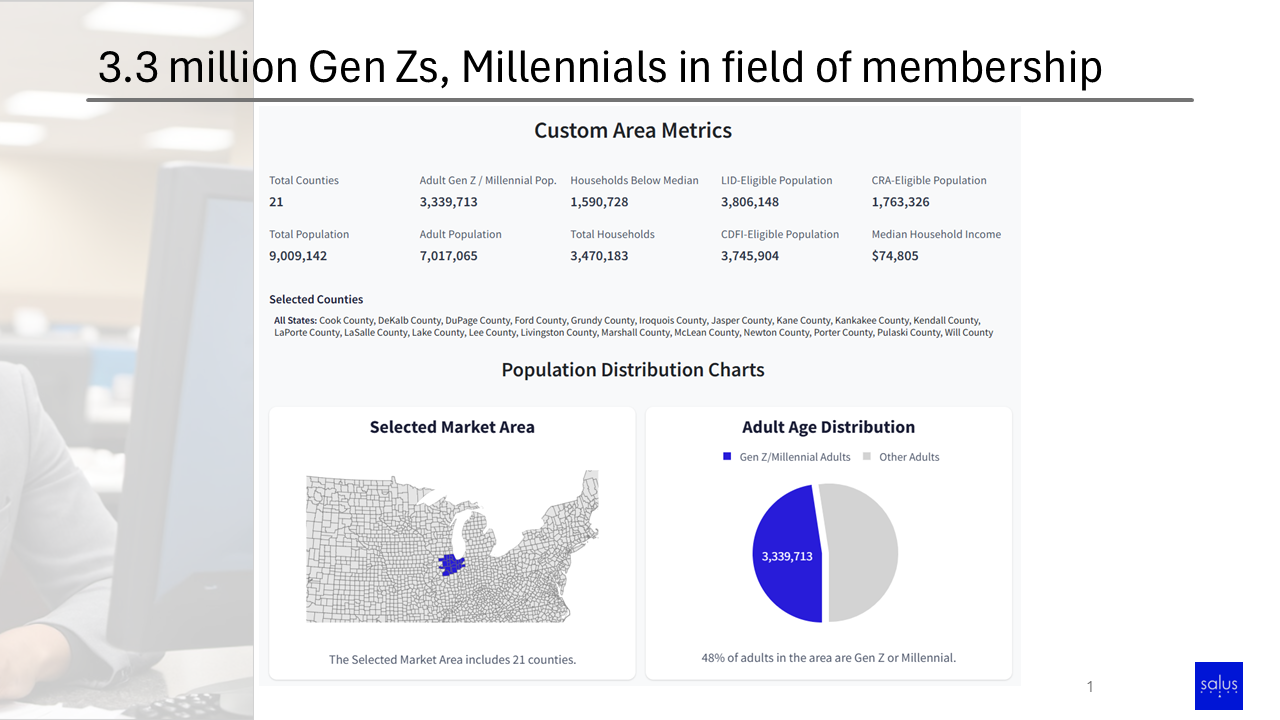

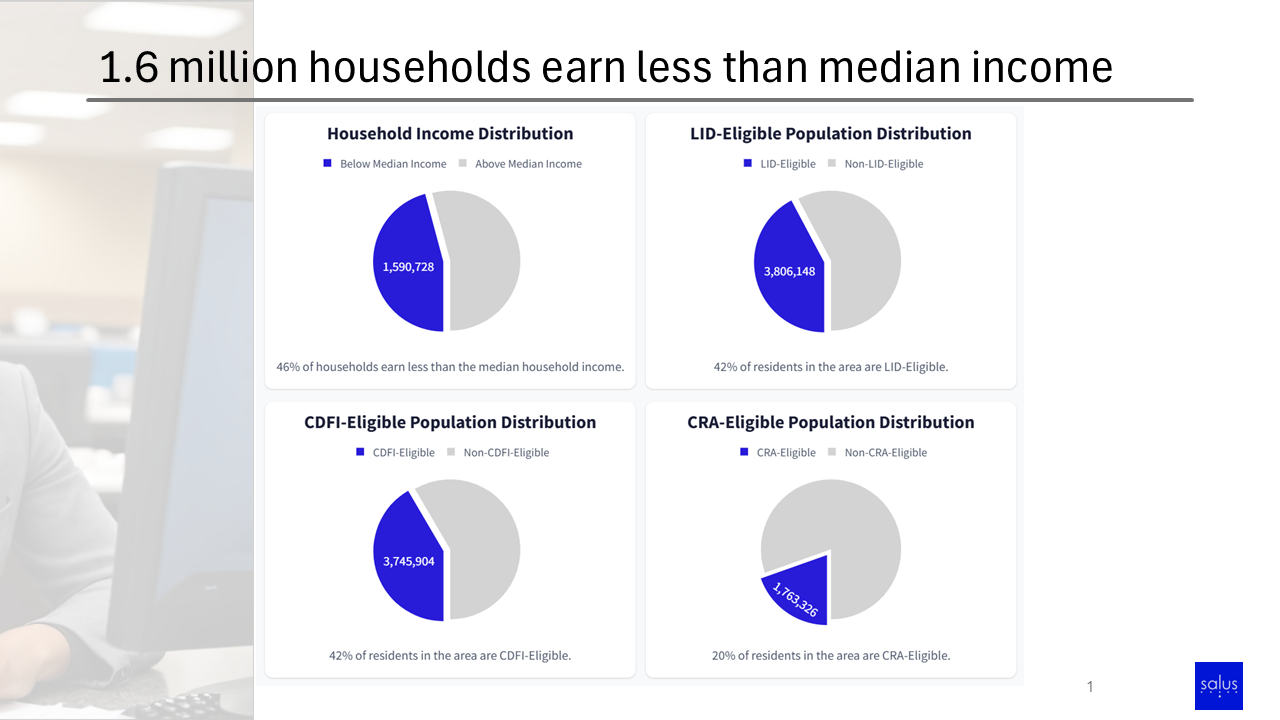

The custom analysis will go down to the county level, showing you how many Gen Z's and Millennial adults live in your area, how many households earn less than the median income, and how many residents are LID, CDFI, or CRA eligible. These are the data points that can turn a well-meaning initiative into a business case with hard numbers.

Fill out your request, and Salus will give you this free custom report for your credit union - because when credit unions lean into financial wellness, everybody wins.

- Solutions -

Digital Tools Built for Impact-Driven Credit Unions

“As emergencies can be unexpected, with Salus supporting us in this initiative, we can lend in minutes so the funds can be there for our members when they need it the most.”

GFA Federal Credit Union

- Why Choose Us -

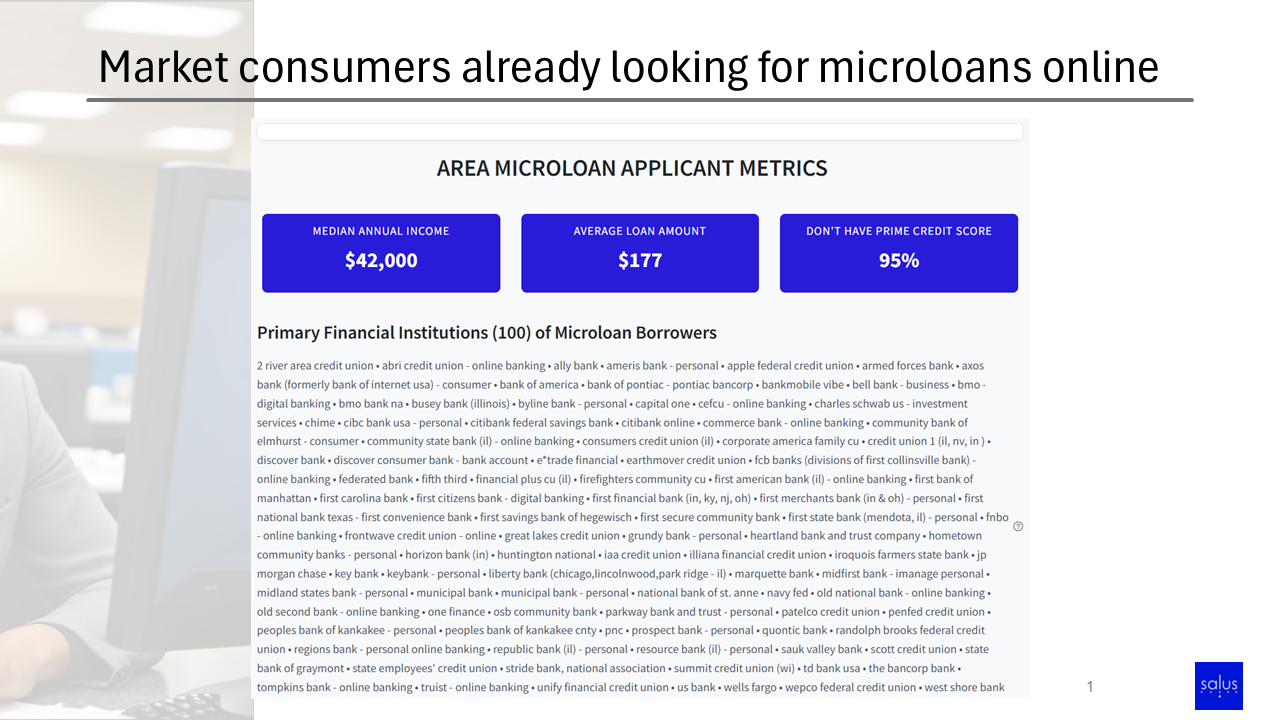

Microloan Borrowers Matter to Credit Unions

75%

Credit unions with members actively applying for microloans away from the credit union.

They need the solution, and when they don't get it from their credit union, they're going elswhere to find it.

$46,000

Median annual income of microloan borrowers across the country.

These are our community's teachers, our first responders. They might be a credit union's front-line staff.

88%

Microloan borrowers that hail from the Gen Z or Millennial generation.

The median borrower age (29) is the exact profile that credit unions are looking to attract and retain.

.png)

- Partners -

Working Together to Empower Financial Inclusion

.svg)

.png)